ACSA Industry Wrap - July 2021

Monday, 26 July 2021

(0 Comments)

Posted by: Kate Dent

|

IN THIS ISSUE

|

|

- Crypto-assets – the next big thing?

- Member events – a good plan needs to be flexible

- Cheque out – the demise of this method of payment

- Listed managed funds – industry dialogue

- Tax Data Standard – published and in use

- In Focus – rising star Marsh Lee is interviewed on life and Calastone

|

|

CRYPTO-ASSETS

|

|

The crypto-asset landscape is in the spotlight, driven both by increased institutional investor interest and consultation with regulators.

At present, ACSA is reviewing ASIC Consultation Paper 343 - Crypto-assets as underlying assets for ETPs and other investment products CP 343. The paper … “is about how exchange traded products (ETPs) that invest in, or provide exposure to, crypto-assets can meet existing regulatory expectations for ETPs. The paper sets out our proposals on good practice for market operators and product issuers so that these products can be facilitated in a way that maintains Australia’s fair, orderly and transparent markets”.

ASIC states that their proposals on good practice for crypto-assets will apply to products other than ETPs including listed investment companies, listed investment trusts and unlisted registered managed investment schemes.

ACSA has also been invited to speak at the AIST Superannuation Investment Conference ASI scheduled for 31 Aug to 2 Sep 2021 on the topic of Digital Assets.

While interest is increasing in crypto assets, it remains early days for actual asset flows. The underlying cryptographic technology is powerful, but may not be the best defining characteristic of the asset. For example, if viewed as a security the framework for digital assets may not be materially different to traditional forms of investment in the context of institutional strength asset servicing and investment administration (and integration within a broader portfolio).

|

|

MEMBER EVENTS

|

|

Our planned member events for later in the year need to stay agile in the face of ongoing pandemic disruption.

Refinement of the program is underway, including guest speakers, along with contingency plans to pivot to a virtual or hybrid event format in need. Physical attendance will, of course, be subject to COVID-related public health guidelines and venue host policy.

|

|

CHEQUE OUT

|

|

The Australian Payments Network (AusPayNet) recently invited engagement on the use ofcheques including to work with organisations that are frequent cheque users to understand their payment needs and to work with them on identifying digital payment alternatives.

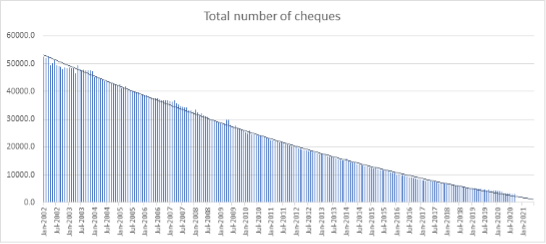

Between 2002 and 2019 the number of cheques used in Australia fell by approximately 90 per cent.

Source: Australian Payments Network Limited

ACSA has been a long-standing advocate of efficiency, including the use of electronic payments over cheques. While ACSA members are not necessarily “frequent users”, the efficiency and risk impact on otherwise automated processes is material when electronic alternatives are not available or promoted. Last year ACSA engaged with share registries, ASIC and the ASX to highlight the challenges of pandemic disruption on physical document movements - including cheques.

The relevant ACSA Communique can be found here.

ASIC and the ASX were supportive, and provided communication to stakeholders through their channels in support of electronic options. A number of ACSA members did point out, however, that there are some types of event/action where cheques are required (for example, mandated in offer documents for take over acceptance, IPOs, etc) as well as circumstances where bank account details are not held for receiving parties.

The Australian Payments Network initiative is an opportunity to further highlight these issues, and seek broader engagement on promoting electronic payment options. As the graph above shows, use of cheques will increasingly become an anachronism.

|

|

LISTED MANAGED FUNDS

|

|

In June’s Industry Wrap we highlighted increased interest in managed funds that co-exist as open and closed structures (that is, they trade on regulated markets that settle on CHESS, but also via bilateral orders for applications and redemptions to the issuer’s registry as a traditional unlisted fund).

While not new (ETFs share these characteristics and have been listed in Australia for over 20 years), recent innovation has seen existing unlisted funds, including actively managed, convert to the dual structure.

For asset servicing firms, platforms and registries, there can be potential challenges in these fund types, including managing asset identification, fund data, corporate actions, settlement flows, HIN to SRN conversion and KYC considerations (for example, an investor acquires on market, but subsequently trades direct to register). Working through issues avoids potential service impacts, opportunities for greater efficiency and improved customer experience.

An industry sub-group met this month to share insights and review areas for additional market education, positive change and common practice. The sub-group is currently considering which issues are systemic in nature, and next steps in sharing with the broader ACSA community.

|

|

TAX DATA STANDARD

|

|

Thanks to the hard work of the sub-group, ACSA proudly published final versions of the project artefacts this month, including:

- Tax Data Standard

- Tax Data Schema

- Tax Data Schema – Tax Statement/ITR/AIIR mapping table

A communication has been issued to the ACSA member base informing them of the final Tax Data Standard and related materials, with copies of the standard available on the ACSA website.

The standard is available free of charge, and all members are encouraged to apply the standard, promote and maintain momentum towards adoption and ultimately via digital exchange. Pilot programmes are expected to be driven by technology providers utilising the standard as a base.

ACSA is also engaging with other parties, including a meeting scheduled with the FSC in August to boost awareness and explain the benefits of the standard.

Stewardship of the standard and ongoing maintenance will reside with ACSA Tax Data Sub WG.

Finally, a big thankyou to Jodie Bosler who chaired the Tax Data Sub WG and for expert contribution from the following participant firms:

|

|

IN FOCUS

|

|

Marsha Lee, Director Client Relationship Management with Calastone in Sydney is an active participant in the Australian Custodial Services Association. For this In Focus feature, ACSA Members and Services Working Group member Tanya Dioguardi caught up with Marsha to hear about her career, being part of the ACSA community and perspectives on market challenges.

|

|

Tell us a little about your career, and how this experience has helped in your current role with Calastone?

My first foray into the Custody world was back in 2004 with Westpac then later with HSBC in roles spanning operations and relationship management. This 10+ years of experience in custody has given me great exposure to equity, fixed income, managed funds, and cash processing, as well as an in-depth understanding of the operational and technical complexities of custody operations. I was fortunate in being selected to work on a project, with HSBC, in London as part of a European build-out project for their payments and cash management business which really helped widen my perspective beyond the Australian market. I’m hugely appreciative of my colleagues, past and present, who over the years have been so instrumental in my continuous learning.

Starting my career in operations has given me a strong understanding of the funds value chain which has proved invaluable as I moved into relationship management. In my role I interact with clients and stakeholders from all organisation types. Knowing the ‘why’ and understanding ‘what’ they are trying to achieve, and their challenges is a valuable foundation to collaborate together.

Why do you choose to get involved with ACSA and what value does membership bring?

ACSA provides an environment where stakeholders, from all sides, can come together in a ‘safe’ space to improve the industry as a whole through sharing and collaboration. It’s a huge positive there are so many innovative thinkers across the managed funds and securities industry wanting to make a positive change for the betterment of all.

Being part of ACSA provides Calastone with the opportunity to participate and contribute to the market dialogue, share insights we hear from clients, and share learning from around the world that may help Australian specific market challenges. This dialogue allows us to better understand our clients and enables us to take practical requests from the industry for potential future product ideas and enhancements.

We are actively involved in a number of the working groups, notably the Operations WG and Funds 2.0 taskforce, where members worked together to formulate a workflow to address the recognised inefficiency in the current managed fund reconciliation process.

I’ve really enjoyed working with ACSA and its members on various initiatives over the years through forums that ACSA has provided. This is a really exciting time for the industry as the acceleration of technology provides so much new opportunity for the industry to go further, significantly improve efficiency and address the needs of the modern digital investor.

What are the major industry problems that you see in the market at the moment?

In recent years we have increasingly seen digitisation as a key driver for market participants as they strive for growth and optimisation. Through participation in market dialogue and client engagement part of my role is to ensure that the right digital tools are identified to support that journey to transformation. The industry globally is moving at a fast pace and with that the demand for digitisation, as a technology company we’ve invested in digital tools, including DLT, to create our Distributed Market Infrastructure (DMI) giving us the infrastructure to continue to innovate.

Another key challenge is managed fund settlement and the ability to pair trades and cash movement seamlessly to enhance efficiency. A recent study from Calastone found increasing demand for further automation with 80% of firms specifically favouring adoption of trade-to-cash settlement processing. Market participants are seeking greater trade certainty and visibility over their liquidity, together with my team in Australia we have been working closely with a number of key clients to shape a solution. It’s a type of project that I’m passionate about and excited to unveil later this year.

|

|