ACSA Industry Wrap - Feb 2023

Monday, 6 March 2023

(0 Comments)

Posted by: ACSA Admin

|

In this issue

|

- ACSA Award winners

- ACSA Priorities for 2023

- New and re-focused working groups

- ACSA Thought Leadership Series

- ACSA tax data standard – ready for implementation

- Global perspective – Corporate Action Data Sourcing

- In Focus – Christopher Moore (Citi)

|

|

Introduction

|

|

In this edition of the ACSA industry wrap we are excited to share with you our 2023 ACSA Award winners, recognised for their outstanding commitment and industry drive.

We also share the ACSA focuses and priorities for 2023, following a strategic planning day from the ACSA Executive Board, the next webinar in the ACSA Thought Leadership Series, and some local and global initiatives around data standards and data sourcing.

And we are In Focus with Chris Moore from Citi Securities Services.

Finally, our first members events for the year, to celebrate the success of our award winners and share the ACSA focus and priorities has received a great response with over 150 people registered to attend across Sydney and Melbourne. Watch out for the photos on LinkedIn and in the next edition of the ACSA Industry Wrap

|

|

2023 ACSA Award Winners

|

|

The ACSA Awards recognise outstanding individual contribution to the Association, wider industry and key stakeholders. For over 10 years these coveted Awards have showcased outstanding individuals and the value they bring to industry collaboration and focus on positive change.

The Award Winners are:

Marsha Lee, Director Client Relationship Management, Calastone.

Marsha brings deep working knowledge of the managed funds segment and understanding of the various pain points that drive Calastone's technology innovation and focus.

Marsha Lee has been instrumental in bringing managed fund efficiency back onto the ACSA priorities through her commitment to continue to improve the industry. Marsha agreed to coordinate the establishment of a working group to take forward issues related to managed funds and to be the inaugural chairperson.

Marsha is driving the industry agenda on critical issues such as dual ISINs and lead a survey of the industry to create the agenda to improve operational processes in line with the ACSA philosophy of best practice and efficiency.

Douglas McMeekin, Associate Director Tax Policy and Services, NAB Asset Servicing

Doug is responsible for overseeing the teams setting and applying tax and accounting policy for NAB Asset Servicing's clients.

Doug has made a tremendous contribution to the industry in his capacity as deputy chair of the ACSA Tax Working Group in 2022. This includes involvement in the new ACSA tax data standard to achieve both Financial Services Council support of the template and support from the ATO.

Doug also took a leadership role in the ATO consultation on 3rd party tax controls for the custody industry, which has lead to enhanced understanding by all parties of the role that the custodian plays in preparing investment tax reporting for clients, and the comprehensive suite of controls utilized by the industry to ensure compliance

|

|

ACSA Priorities 2023

|

|

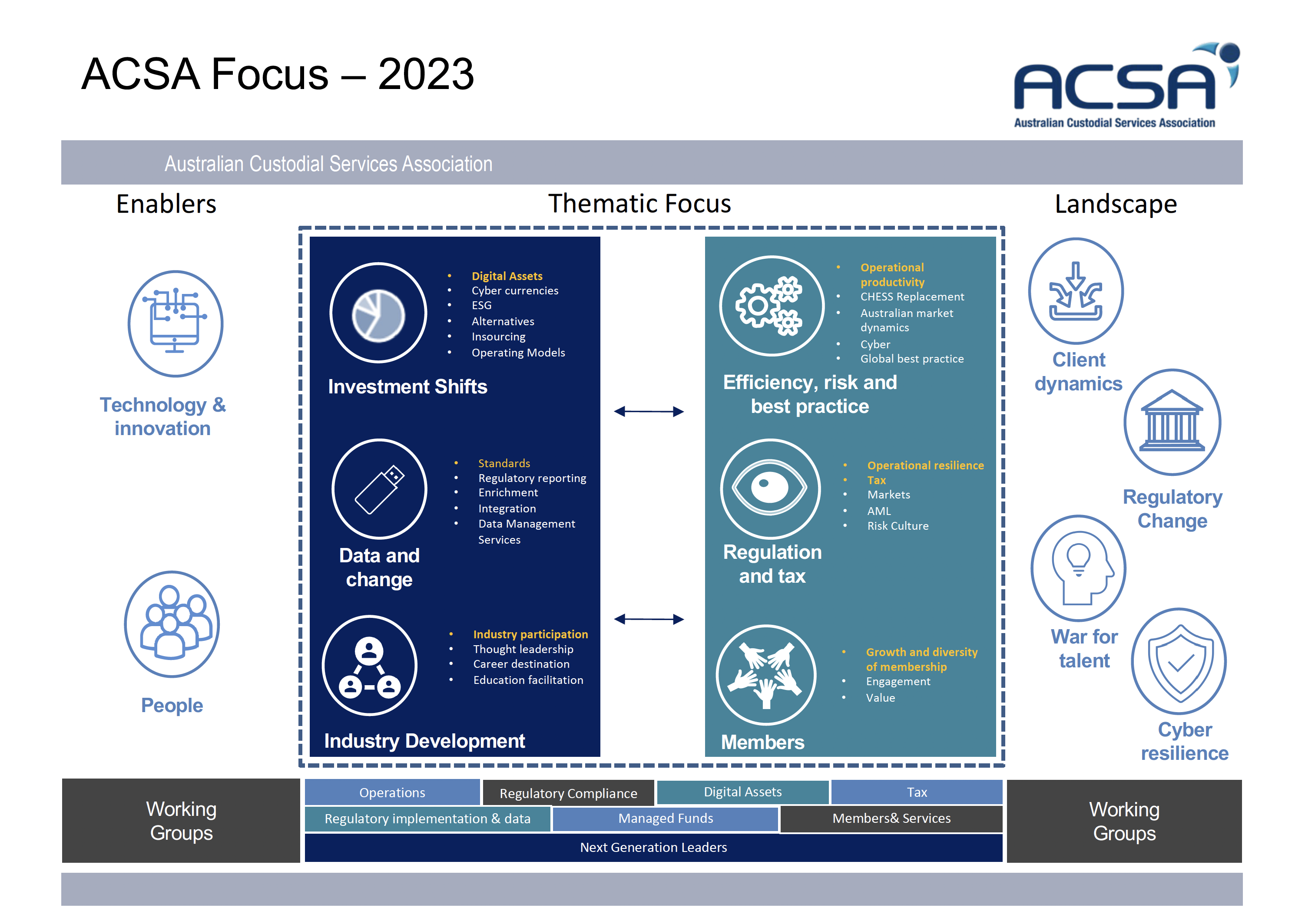

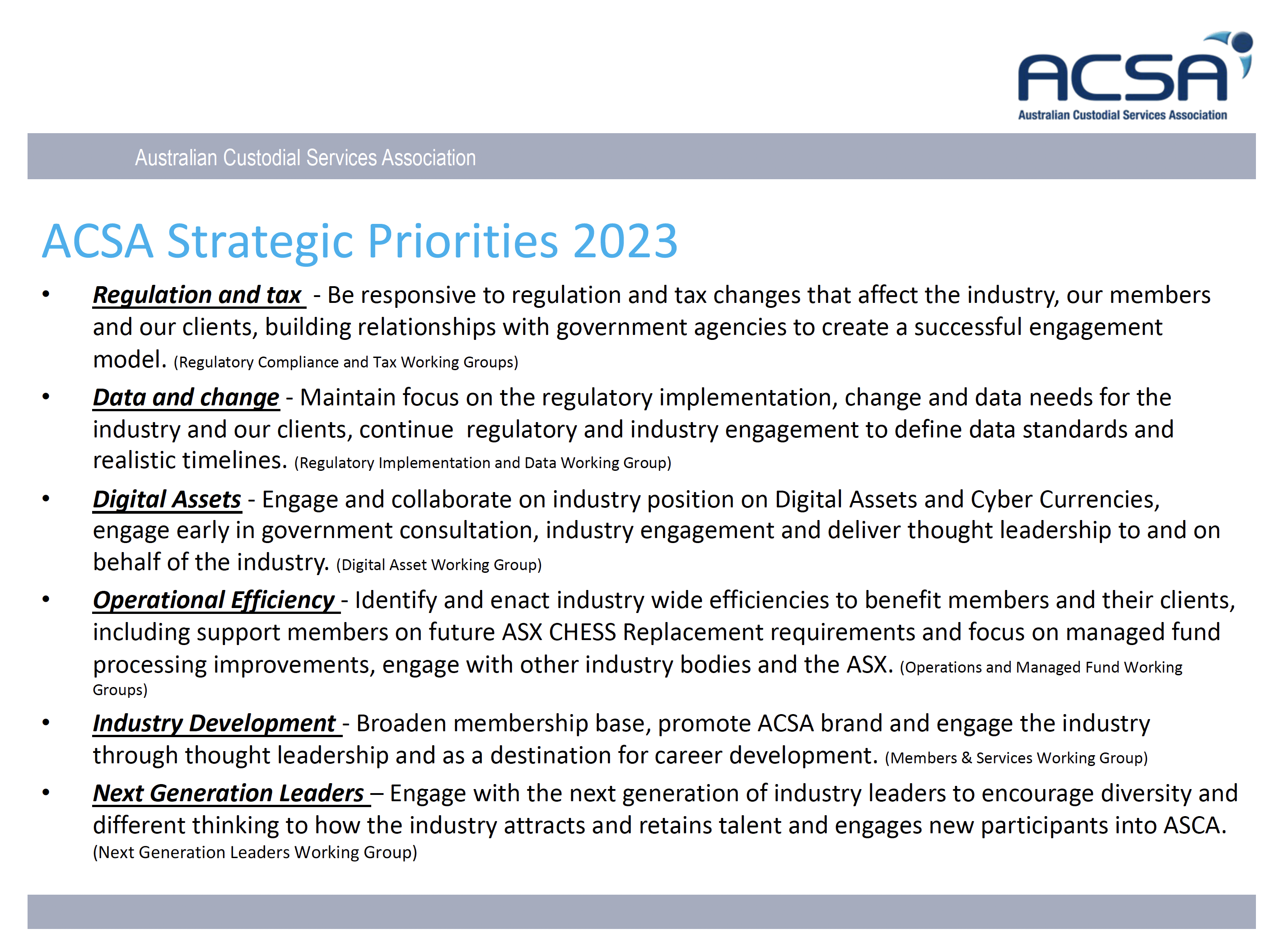

The ACSA Executive Board met in February to discuss the focus and priorities for ACSA in 2023. This included some insightful presentations from Gordon Little at IRESS, on digital assets and crypto, and Craig Cummins and Ken Woo from PwC, on market direction and regulation.

Here are ACSA’s 2023 focus and priorities:

|

|

New and re-focused working groups

|

|

Whilst the priorities and focus for ACSA remain similar to last year, there are some important changes.

New and re-focused working groups.

|

Regulatory Compliance

|

Regulatory Implementation and Data

|

This recognises the importance of ACSA remaining focused on both the implications of regulation on our members licensing obligations but also the need to contribute to the discussion on the impacts of regulatory change on members clients and members products and services.

|

Digital Assets and Crypto

|

Increasing focus on the need and industry drive for investor protections in this innovative segment of the market by moving from a taskforce to a working group.

Recognition of the importance of the Next Generation of Leaders in our industry through the formation of a new working group to engage and embrace those new to the industry on how they achieve their career aspirations and help ACSA evolve for future generations of industry participants.

If you’re interested in joining one of these working groups, please contact admin@acsa.com.au.

|

|

ACSA Thought Leadership Series

|

|

ACSA’s Thought Leadership Series continued in March with SWIFT discussing Smarter Securities to transform securities flows.

In this webinar, Swift will share how it is collaborating with the securities industry to enable smarter securities transactions focusing on delivering end-to-end transaction tracking for securities settlement transactions while exploring the potential of tokenised assets.

To help us understand where we are headed, ACSA is honoured to have regional leaders from SWIFT, the financial industry’s neutral and trusted infrastructure provider.

SWIFT helps over 11,000 institutions move value around the world reliably and securely, and fundamentally transforming payments and securities processing to help navigate today’s complex challenges and remain prepared well into the future

Sign up to the Webinar here.

The webinar will be recorded and will be able to be accessed on ACSA’s website for further viewing.

|

|

ACSA tax data standard - ready for implementation

|

|

ACSA has developed a standard data set and common market practice guide for automating the exchange of Australian managed fund tax data. Use of the standard will benefit both publishers and recipients of tax data (and ultimately end investors) by improving operational efficiency and reduced risks. ACSA has developed the Tax Data Standard with the support of Paul Toepfer from Konu Consulting.

The objective is not to replace the existing statements, but to facilitate more efficient, timely and automated delivery of fund tax data amongst organisations.

The use of a standard data format will support the calculation and distribution of statements and cash to investors. The objective of the Tax Data Standard is to provide an industry model that delivers efficient exchange of fund tax data, materially reduces operational risk, removes ambiguity and lowers query rates for both producers and receivers of fund tax data.

The intended users of the standard are B2B organisations that exchange tax data, including:

- Investment administrators, including those performing net asset value calculation and/or unit pricing, fund accounting and/or tax services for managed investment schemes and complying superannuation funds

- Fund issuers, including Responsible Entities / trustees of wholesale collective investments, investment/asset managers

- Custodians offering services to local and foreign investors

- Investor Directed Platform Service (IDPS) and Managed Account operators

- Registry providers

- Technology providers interested in streamlining process automation.

ACSA members are currently engaged in multilateral discussions with their clients, unit registries and other data platforms to roll out the Tax Data Standard. ACSA is discussing the Tax Data Standard with the Financial Services Council (FSC) and the ATO to ensure industry acceptance and robust governance of the data standard.

|

|

Global Perspective - Corporate Actions Data Sourcing

|

|

The sourcing of Corporate Action data is, for many in Securities Services, an ongoing challenge. Issues, such as inefficient processes and ineffective market regulation, continue to impede the ability of the industry to provide accurate, complete, and timely information.

These issues, however, are not only affecting the Securities Services industry. They also impact the flow of information to brokers, fund and portfolio managers as well as – ultimately – end-investors. As a result, the ISSA Asset Servicing Working Group (WG)

created a subgroup to investigate the challenges of sourcing Corporate Action data, with the aim of identifying viable solutions which the financial market could adopt.

The ISSA paper is the outcome of their WG’s review. It provides information which:

- Identifies the key challenges faced by Securities Services providers when sourcing Corporate Action data

- Gives the rationale for change

- Offers different potential solutions as well as `Fast Facts` on certain markets which have already transformed the way they source data

- Outlines the benefits of moving to a Single Source model as well as offer best practice guidance to those who are currently considering this change.

The ISSA paper can be found here

.

|

|

In Focus –Christopher Moore

|

|

|

Chris is Citi’s custody product manager covering the Australia and New Zealand.

Chris joined Citi in 2006, and held 16 roles in 5 countries over 12 years before taking a sabbatical in 2018 to return home and open a cocktail bar in Melbourne. Following the opening of the bar, Chris spent just shy of 3 years at J.P. Morgan in their Securities Services Product division, before returning to Citi in 2021.

C

hris is an avid writer and musician in his spare time, and enjoys seeing new places in the world.

|

|

Quick fire five

Coffee or Tea? Coffee

Tik Tock, Instagram or Facebook? Tik Tok

Pop, Rock or Rap? Rap

Cocktail or Wine? Cocktail

Summer or Winter? Winter

First of all congratulations on a successful career to date, what have been your career highlights and what are looking forward to?

I’ve been fortunate enough to spend just over 5 years working overseas around the region, with roles in India, Japan, Singapore, and Malaysia. That experience showed me that there is more that unites us than divides us in the world and changed my perspective on what’s important and how we should invest our time. I’ve always been a very change-centric person and I try to help shape the business environment I’m a part of to give people meaningful work to do, and minimise bureaucracy and low value added tasks. I’m looking forward to finding opportunities to get more involved in industry growth and change, and be a part of discussions that formulate where we are headed.

How did you first begin working in financial services/asset servicing?

Like many people, I sort of fell into it. When I was looking for my first job, a friend of mine’s sister was hiring at Citigroup Wealth Advisors (which is now owed by Morgan Stanley). My first job was account opening and maintenance for client accounts, but I wasn’t very good at that so they demoted me and my job was to print and distribute faxes to the whole floor, which we shared with custody. The custody team noticed I was quite good with faxes and given our clients liked to send so many of them, they offered me a job in custody settlements, and I transferred across. 15 years later here we are, although I did spend some time in banking and markets in between.

You’re involved with ACSA as a working group chair, tell us about that experience and the value ACSA brings to the industry.

Custodians form a unique and under-appreciated part of the world’s financial infrastructure. We act as a cushion between our clients, who need access to markets around the world, and the inefficiencies and vagaries of a plethora of different financial market infrastructures, all at different stages of development and growth. ACSA works quietly and determinedly to make the market safer, faster, and more accessible to local and international investors, and educate the industry on what battles need fighting. It’s a privilege to be a part of that process, and I have learned a lot from peers and seniors in the industry through this role. I only wish it had come at a time when CHESS Replacement wasn’t dominating the discussion quite so much.

What advice would you give to the younger professionals the industry?

Custody and Funds Services is an area that requires deep expertise, and the nature of the game is changing as data becomes richer and more accessible. The industry is going to look very different in 20 years’ time to how it does today, but the core skills of building a good network, putting in the time to understand the industry and landscape, and having a working understanding of where technology is going, will always be vital. Also remember that things are the way they are for a reason so “measure twice, cut once”.

|

|